In a trend that’s become increasingly popular over the years, many Indian founders register their startups in the West or Singapore. Why, you may ask? The benefits are aplenty. For starters, it makes fundraising easier by allowing them to find more institutional and technological investors.

However, not everyone is impressed by the idea of foreign-born startups of Indian founders.

Snapdeal co-founder Kunal Bahl, who recently shared a detailed thread on X, argues that Indian startups should be incorporated domestically rather than overseas. His stance challenges what was once conventional wisdom among Indian entrepreneurs who believed foreign incorporation provided fundraising advantages, including easier exits.

“In 2025, that’s outdated. Today, incorporating in India isn’t just patriotic—it’s pragmatic,” Bahl said. “Indian investors now back all kinds of startups, including deep tech and AI, and one doesn’t need to find investors overseas to fund these spaces,” he explained.

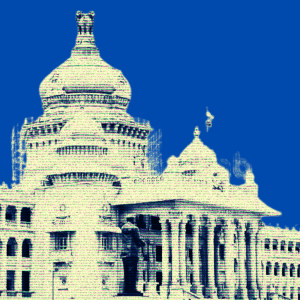

Bahl argued that recent government initiatives have brought in improved taxes and regulatory clarity for Indian startups. In the 2024 Union Budget, finance minister Nirmala Sitharaman announced the abolition of angel tax (effective FY2025-26) for all investor classes, addressing a long-standing concern in the startup ecosystem.

The tax, which previously treated investments above fair market valuation as income, had been a significant deterrent for domestic incorporation.

Additionally, the finance minister extended the definition of “eligible startup” under the Startup India scheme to include entities incorporated between April 1, 2016, and March 31, 2025. It allows more startups to benefit from the tax holiday offered under the scheme, directly supporting Bahl’s point about India’s startup-friendly tax policies.

Are Startups Really Coming Back?

In 2025, over 90 companies have filed their draft prospectuses in India, aiming to raise an estimated INR 1 trillion or $11.65 billion. About 34 companies have either already raised or are announcing their fundraising efforts.

Citing the success of recent IPOs like Zomato, Nykaa, and Unicommerce, Bahl said that the Indian market is ready. “If you plan to list in India, incorporating here avoids costly ‘flipping’ later,” he said.

Quick-commerce platform Zepto announced its ‘ghar wapsi’ in January 2025, moving from Singapore to India. This aligned with the company’s plans to launch its IPO, making KiranaKart, its domicile holding in India, the parent company. However, they are expected to attract a huge tax bill for this ‘flip’.

Meanwhile, Groww, a financial trading platform, shifted its domicile status from the US to India last year under its parent company, Billionbrains Garage Ventures.

Walmart-owned Flipkart is also reportedly planning to move its domicile from Singapore to India for the same reasons. According to a report by The Economic Times, Meesho is reverse flipping from Delaware in the US back to India, while Pine Labs is also moving back from Singapore. PhonePe is also moving back to India and is eyeing an IPO.

In a previous interaction with AIM, Akash Aggarwal, MD (investment banking) at Motilal Oswal Financial Services, reflected upon the same.

Having participated in several IPOs in the past, Aggarwal said that despite the claims of the market being down, IPOs are seeing decent subscriptions among Indian investors. “A majority of the money comes from Indian investors and not foreign investors,” Aggarwal told AIM.

He added that as of January 21, 2025, the BSE index had fallen by almost 10% compared to September 2024, when the market surpassed the 84,000 mark, its highest ever.

“Almost 70-80% of the interest is from domestic investors. Of the several companies that I am in touch with, some are going IPO, and I think this is the right time for it because it might take at least 9-12 months for them to launch the deal,” Aggarwal said, adding that if a company is mature enough, it should think about it.

In an interview with BusinessLine in January, Mahavir Lunawat, chairman of the Association of Investment Bankers of India, said that Indian firms used to take pride in raising funds abroad, but now foreign firms line up to raise funds in India.

The Department for Promotion of Industry and Internal Trade (DPIIT) recognition system provides substantial benefits to domestically incorporated startups which includes tax exemptions and a simplified compliance process, as highlighted by Bahl in his thread.

The Problem with Ghar Wapsi

Vaibhav Dusad, co-founder of SurgeGrowth, while speaking about Bahl’s analysis on LinkedIn, said that it completely misses the ground reality. “Sentiment-wise, I’m all in—build in India, win from India, keep the tax rupees here,” he said. “But as a SaaS founder who’s actually done it, I can tell you it isn’t as shiny as the pitch.”

Dusad said that India’s IPO market is a legit exit path since $5 million in revenue can get startups there, which is much less compared to the half a billion that startups in the US look for. “In the US, it seems too unrealistic to do an IPO—even biggies like Stripe haven’t done it yet,” Dusad added.

He highlighted problems like the KYC process when wiring money from the US and the poor infrastructure. “In India, you’re not just fighting for customers—you’re wrestling with bureaucracy and red tape. Ultimately, your focus is diverted from what matters most: building your product!”

However, the continued emergence of Indian unicorns supports Bahl’s perspective. In February 2025, the banking technology platform Zeta became India’s newest unicorn, reaching a $2 billion valuation with its latest funding round.

According to data from AIM Research’s AI Startup Funding Report India 2025, early-stage funding experienced a substantial reduction of 37% compared to last year. It indicates that investors are looking for startups that have significant market viability. However, this is just for AI startups in India.

According to Tracxn’s Geo Annual Report – India Tech–2024, a total of $11.31 billion were raised that year, which is an increase of 3.68% compared to $10.91 billion raised in 2023, but a significant drop of 56.17% compared to $25.80 billion raised in 2022.

These market conditions raise questions about Bahl’s first point that “nearly all VCs are funding Indian entities”. While Indian investors may indeed be willing to back various types of startups including deep-tech and AI ventures, the overall funding environment appears constrained.

Six startups — Cashfree, Zeta, ToneTag, SpotDraft, Udaan, and Geniemode — raised more than $50 million in 2025 alone. This demonstrates that significant funding remains available for promising Indian-incorporated startups.

Meanwhile, in the second half of 2025 and 2026, at least 60 companies are expected to seek exits through IPOs, mergers, or acquisitions.

As Dusad put it: “Incorporate in India if you’re playing the long game—IPOs & local pride are worth it. But if you’re early-stage, chasing PMF, and need to move fast, the US is still king.”