The latest wave of US sanctions on chip exports has put China in the spotlight, forcing the country’s tech sector to adapt quickly. Chinese tech companies are actively investing in homegrown technologies in an attempt to mitigate the impact of US sanctions, particularly in the semiconductor sector.

This reflects a broader strategy of self-reliance, driven by restrictions on access to advanced US technology. While official statements and industry developments indicate notable progress, significant challenges still lie ahead.

The Chinese embassy in the US said in a post on X that US President Donald Trump’s imposition of new tariffs on Chinese imports will not affect China. “If war is what the US wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end.”

China Pushes Forward with New Innovations

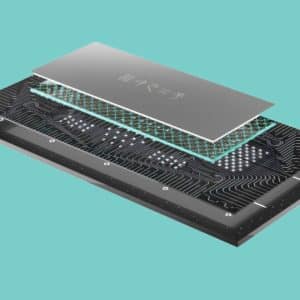

With a strong local demand and supply chain, China has recently made a notable breakthrough in the semiconductor industry. The latest development is China’s latest silicon-free chip, which uses bismuth-based materials to bypass silicon-based restrictions.

According to South China Morning Post, one key development of this 2D transistor from Peking University is that it reportedly operates 40% faster and uses 10% less energy than leading 3-nanometer silicon chips from Intel and Taiwan Semiconductor Manufacturing Company (TSMC).

Professor Hailin Peng, who is leading the project, described this as “changing lanes” in the semiconductor race, born out of necessity due to sanctions, forcing researchers to find fresh solutions.

On the other hand, C4D Lab, University of Nairobi’s R&D and innovation hub, expressed skepticism as it stated, “If true, silicon might need to start job hunting, do you think?” This leaves room for further debate as the chip’s real-world impact remains to be seen.

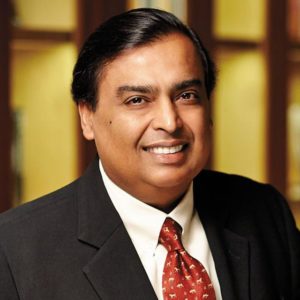

Moreover, companies like Huawei and Semiconductor Manufacturing International Corporation (SMIC) are making breakthroughs and challenging NVIDIA despite sanctions.

Huawei is pushing forward with its Ascend 910C AI accelerator, which Lennart Heim, researcher at RAND, describes as China’s most advanced AI chip to date.

According to Heim’s thread on X, the 910C is now entering production, largely through illicit procurement of advanced dies from TSMC, despite stringent US export controls.

This backdoor sourcing could enable Huawei to produce up to 1 million chips equivalent to NVIDIA’s H100 this year, showcasing China’s determination to circumvent restrictions and maintain its position in the global AI race.

The ability to exploit such loopholes highlights the challenges US policymakers face in enforcing export controls as Huawei taps into stockpiles of TSMC’s 7 nanometer technology and high-bandwidth memory (HBM2E) from Samsung, acquired before tighter regulations were implemented in January this year.

Heim emphasises that while the 910C’s per-chip performance is underwhelming, China can compensate by deploying larger numbers of accelerators, facilitated by its centralised control over resources.

This approach could enable competitive AI models, particularly in areas like reasoning, as China harnesses the talent and compute power it has amassed.

US Sanctions and Chinese Response

US sanctions on Chinese tech companies, particularly in the semiconductor industry, have intensified in recent years.

These measures, such as adding firms to the Entity List and restricting exports, aim to limit China’s access to advanced technologies, especially chips critical for AI, military applications, and supercomputing, as reported by The New York Times.

In response, China has launched initiatives to reduce reliance on foreign technology, including the ‘Made in China 2025’ goal of achieving 70% domestic semiconductor production by 2025.

China’s strategy includes significant state funding, with billions invested in domestic chipmakers like SMIC and Yangtze Memory Technologies Corp (YMTC).

This development is part of a broader trend, with China advancing in RISC-V processors and other non-silicon technologies.

For instance, the XiangShan project aims to deliver a high-performance RISC-V processor by 2025, potentially reducing dependence on foreign technology, Slashdot reported.

These innovations suggest that sanctions may be fuelling, rather than hindering, China’s tech sector. This claim was supported in 2023 by Xu Zhijun (Eric Xu), the rotating chairman at Chinese tech giant Huawei. He had said that China’s chip industry would be “reborn” as a result of US sanctions.

China’s Chip Ecosystem

While technological gaps remain between Chinese manufacturers and global leaders, massive government investment, including a $47 billion semiconductor fund launched in May 2024, and strategic focus accelerate development across all segments, gradually reducing dependency on foreign technology.

The core of China’s chip ecosystem revolves around major players like SMIC, YMTC, and ChangXin Memory Technologies (CXMT).

While Huawei and ByteDance are not directly involved in chip manufacturing, they are crucial in driving demand for advanced semiconductor technologies, particularly in AI infrastructure and mobile applications.

SMIC, China’s leading pure-play foundry, achieved the position of world’s second-largest pure-play foundry in early 2024, despite international restrictions. It successfully developed 7 nanometer chips and announced plans for 5 nanometer production, making strides in chip manufacturing.

In the critical memory sector, YMTC has established itself as China’s champion in NAND flash memory production. Founded in 2016, YMTC has progressed from basic memory architectures to complex 64-layer 3D NAND structures, marking the country’s entry into this strategic segment.

Notably, CXMT serves as the country’s primary Dynamic Random Access Memory (DRAM) manufacturer, working to reduce dependency on foreign suppliers for this essential memory type. Hua Hong Semiconductor complements these efforts by manufacturing analogue, mixed-signal, and specialty semiconductors.

The equipment manufacturing sector, vital for true technological independence, includes Shanghai Micro Electronics Equipment (SMEE) and Advanced Micro-Fabrication Equipment Inc (AMEC). At the same time, Naura Technology Group offers semiconductor production equipment, reducing reliance on foreign technology providers.

China’s ecosystem also features innovative design houses, including HiSilicon (Huawei’s former chip design subsidiary), Zhaoxin (x86 compatible processors), and Loongson (MIPS-based CPUs), and UNISOC (mobile SoCs).

These companies’ strategies are pivotal in countering US sanctions by reducing reliance on foreign technology. The country is also a global leader in semiconductor packaging, holding over a quarter of the global market share. This allows it to maintain influence in the supply chain despite US restrictions.

As the global tech race intensifies, China’s push for semiconductor self-sufficiency could disrupt global supply chains and redefine tech leadership. The impact of US sanctions has accelerated not only China’s domestic innovation but also that of various other countries. This could likely hint towards an era of protectionism for the global chip market.