India’s venture capital (VC) market is showing signs of recovery, but it’s still struggling with a significant gap in its AI ecosystem. Despite the rebound in overall VC funding – up to $11.2 billion in 2024 from a sharp decline in 2023 – India’s AI startups continue to face challenges.

According to a Blume Ventures report, the VC market peaked at $37.4 billion in 2021 and declined sharply to $10.6 billion in 2023. The report further stated that India is the third-largest country in terms of the total number of unicorns, after the US and China.

While India is home to 117 unicorns, Krutrim AI remains the only AI startup that has reached unicorn status.

VC Sentiment for AI Startups

Before the DeepSeek era, India was touted as the ‘AI use case capital’. However, with the government’s strong push in this regard, the conversation has dramatically shifted towards building a foundational model. The IndiaAI Mission has reportedly already received 67 proposals, 20 of which plan to build LLMs.

According to AIM Research data, Indian AI startups raised a total funding of $560 million across 25 rounds in 2024, a decline of 49.4% compared to the previous year. For global AI startups, funding was around $27 billion from April to June.

AIM has extensively covered the significant investment opportunities available for AI startups in India.

Speaking with AIM last year, Prayank Swaroop, a partner at Accel, said that the 27 AI startups his firm has invested in in the past couple of years would be worth at least five to ten billion dollars in the future, which also includes wrapper-based startups.

“A majority of people can start with a wrapper and then, over a period of time, build the complexity of having their own model. You don’t need to do it on day one,” Swaroop added.

Moreover, Peak XV Partners alone has set aside ₹16,000 crore, adding to the $20 billion available in VC funding. The VC ecosystem has $20 billion ready to invest in Indian startups. AI is currently the most significant theme, with investors showing strong enthusiasm for startups in this field.

Another VC firm, Antler, has also invested in early-stage AI ventures with a $10 million fund.

Meanwhile, incubators from Google, NVIDIA, and JioGenNext, along with government-backed GPU procurements, are also providing startups with resources to grow.

Indian-American venture capitalist Vinod Khosla, who is also an investor in Sarvam AI and OpenAI, also stressed the need for developing regional AI capabilities for national security, citing potential risks of foreign AI being restricted by sanctions.

In terms of resources, India has a strong AI talent pool, though some top professionals are in the US. In 2024, India ranked second in GitHub contributions to generative AI projects, just behind the US.

AI startups span the AI stack, from software applications to cloud infrastructure and hardware. Notably, AIM has an extensive list of GenAI startups.

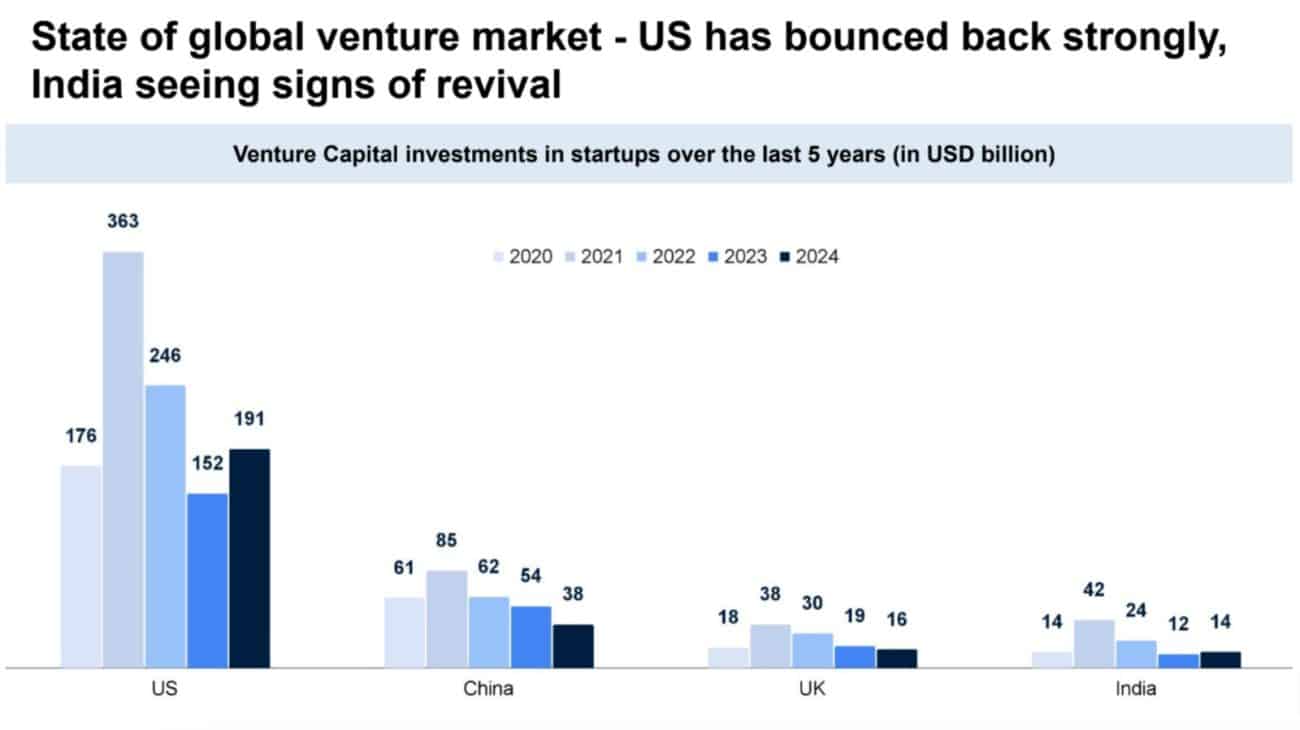

What Is the State of the Global VC Market?

Unicorn creation peaked in 2021, with the US adding 305, China 44, and India 42. After 2022, numbers declined sharply due to a global funding slowdown. In 2024, India added six unicorns, up from two in 2023, but still lower than previous years. The US led with 56 new unicorns, while China added four.

Source: Blume Report

US VC investments peaked at $363 billion in 2021 before falling to $152 billion in 2023 due to economic tightening. However, they bounced back to $191 billion in 2024, driven primarily by the AI, biotech, and fintech sectors. Large venture rounds (over $100 million) followed a similar pattern, recovering to $120.1 billion in 2024. AI alone accounted for $97 billion (or 80% of these deals during this period.

China’s startup ecosystem, on the other hand, has faced challenges since its $85 billion peak in 2021, with investments dropping to $38 billion in 2024. This decline is attributed to regulatory crackdowns, geopolitical tensions, and economic slowdown. Similarly, the UK saw a significant drop in funding, from $38 billion in 2021 to $16 billion in 2024, due to economic uncertainty and declining investor confidence.